Cobalt Information

What is Cobalt?

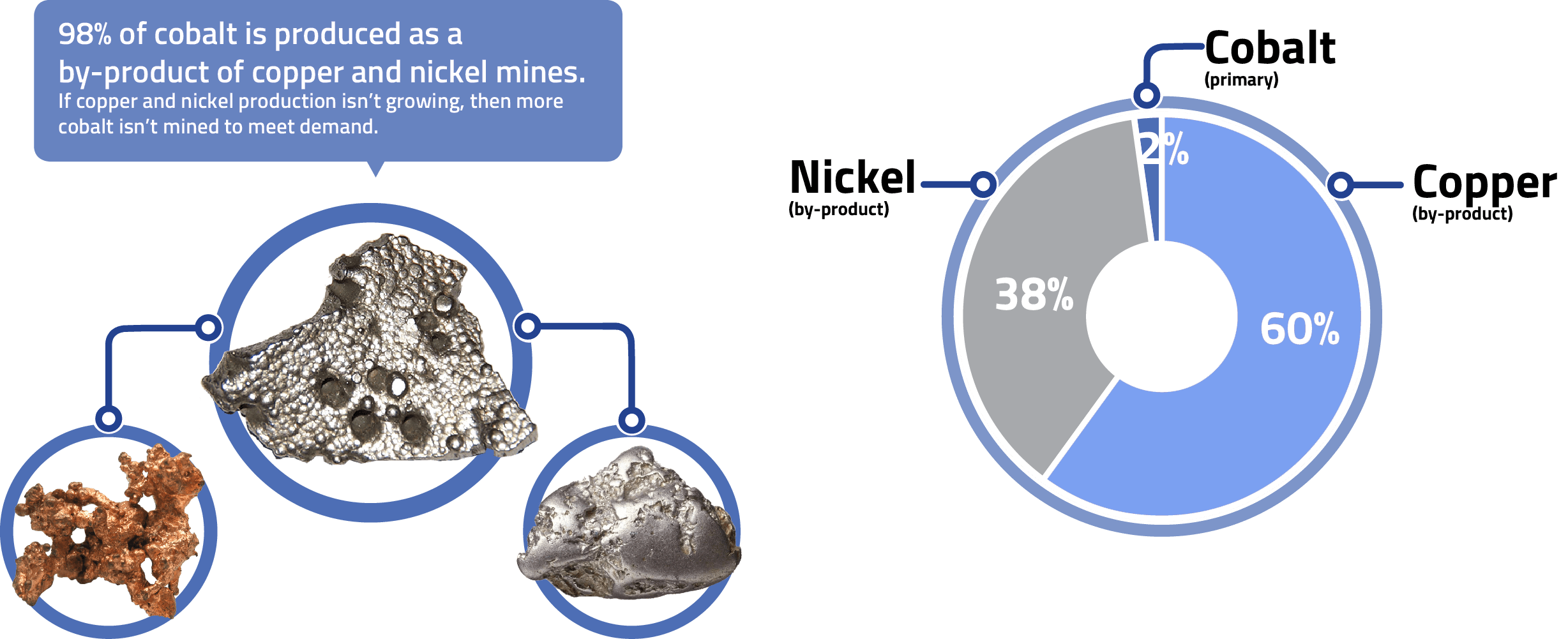

The word Cobalt comes from Kobold — the German word for goblin. Kobolds were spirits that haunted the depths of mine shafts and often caused deadly respiratory problems for miners. Cobalt today is a metal used for a diverse range of commercial, industrial and military applications. Most relevantly for investors, the principal use of cobalt has become electrodes in rechargeable batteries. Cobalt is the red-headed stepchild of metals mining. A mere 6% of cobalt comes from mines focused on mining cobalt. The remaining 94% is the byproduct of nickel and copper mining. That’s why cobalt production is linked closely to the mining of these major metals. No mine in the world would increase nickel or copper production just to obtain cobalt.

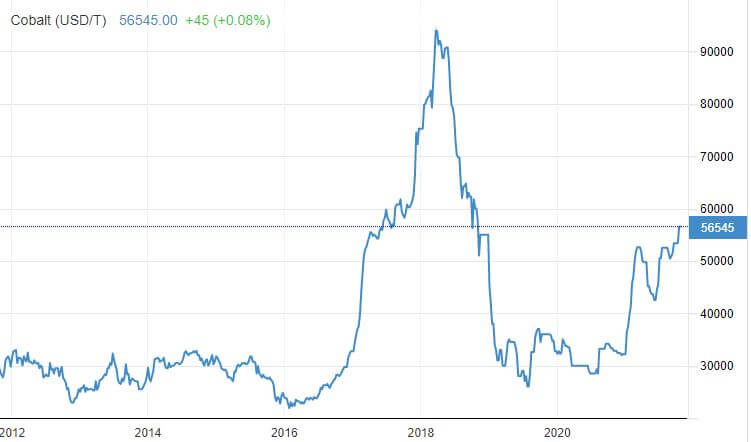

Price is up 145% in a Year

Much like lithium, the cobalt metal market is in the midst of a financial mania. Only a year ago, leading analysts projected that cobalt would hit $16 per pound by 2020. Fast-forward to today, and the price of cobalt has soared over 145% to rise from about $11 per pound to $27 per pound in just over the past 12 months.

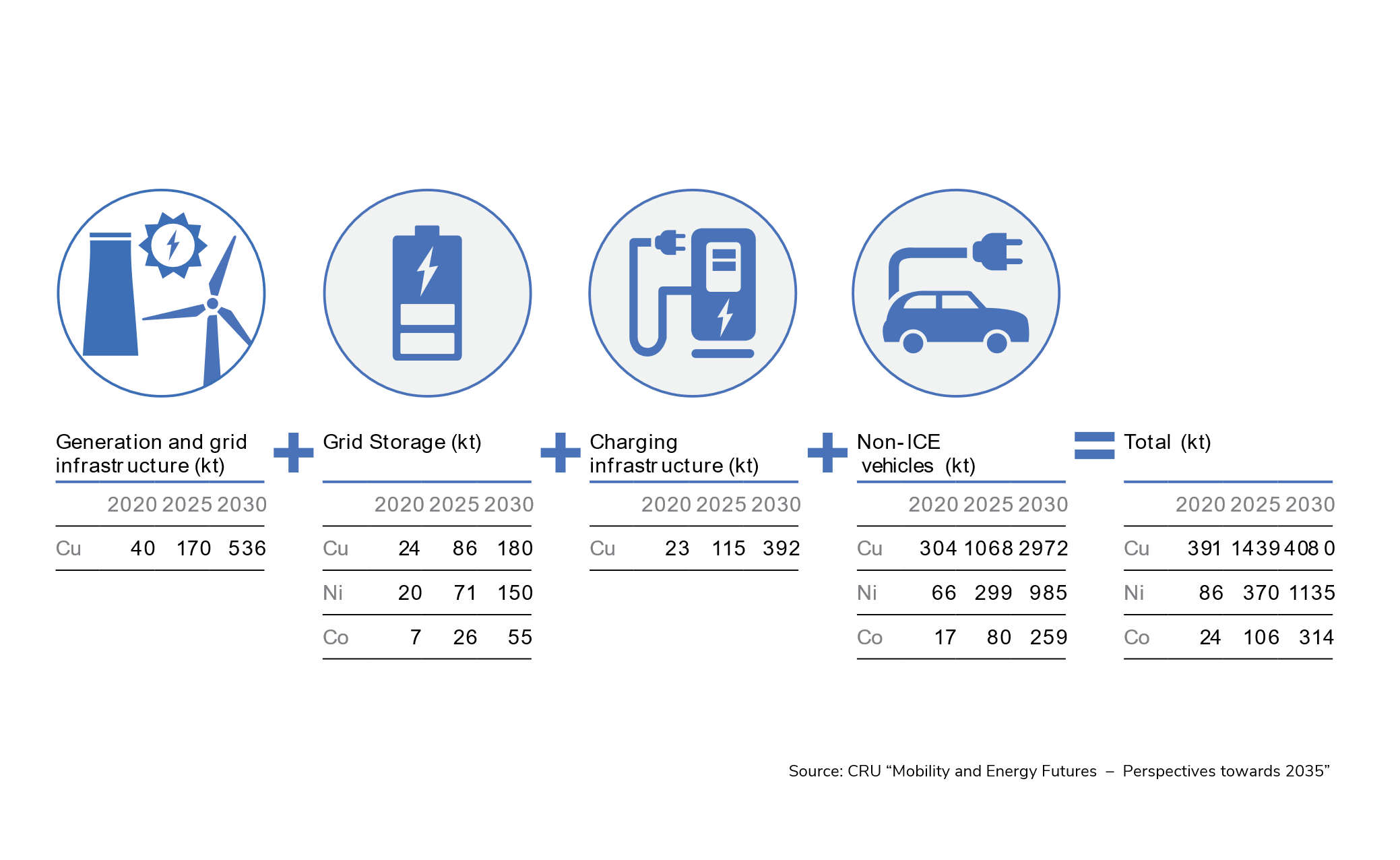

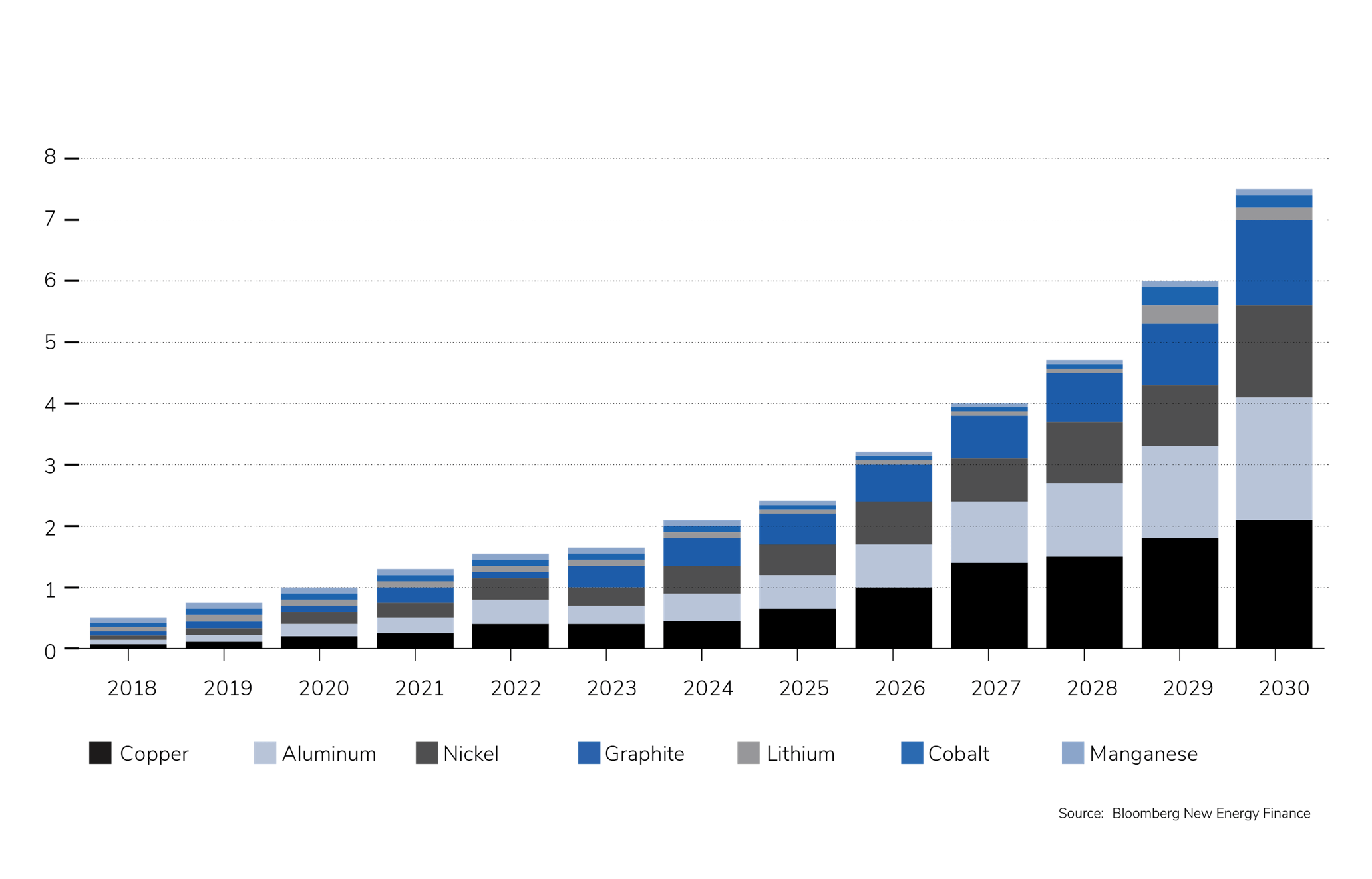

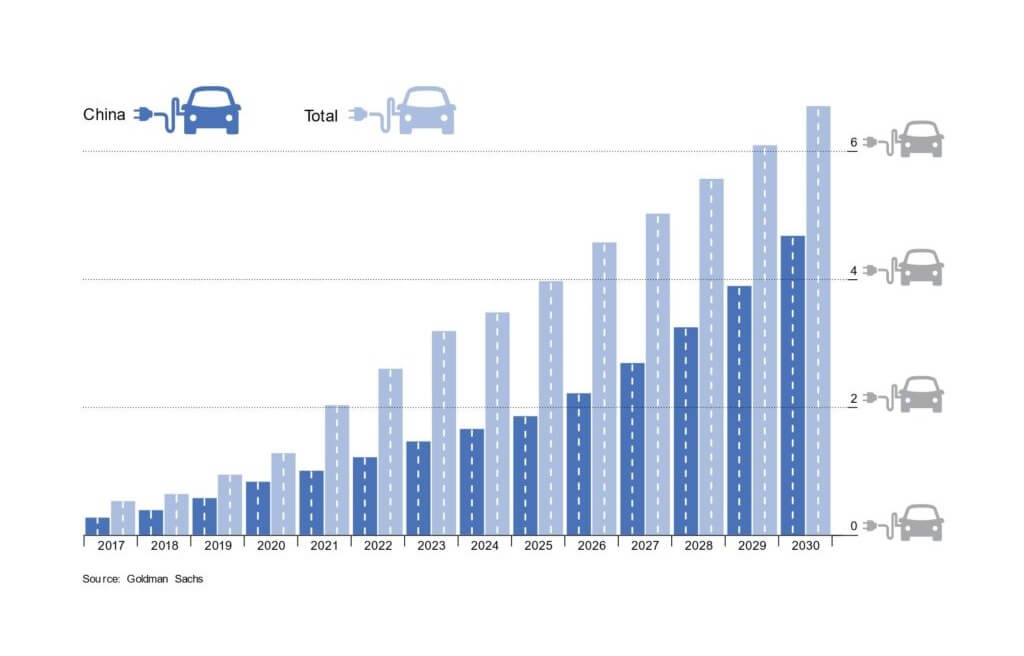

Demand is Exploding

Lithium batteries are used in electronic devices, electric vehicles and energy storage. With today’s technology, 75% of lithium batteries use cobalt. Although lithium has grabbed the headlines, cobalt is actually the tougher challenge for battery suppliers. The latest technology is also shifting in favor of using cobalt. If Nickel-Cobalt-Manganese and Nickel-Cobalt-Aluminium chemistries are set to dominate for all-electric vehicles (EVs), then cobalt will become even more critical than before. The big driver of demand for lithium batteries is, unsurprisingly, electrical vehicles. CRU Group expects global electric car and plug-in hybrid vehicle sales to top 17 million in 2030. That compares with sales of 778,000 EVs in 2016. The World Energy Council expects that every sixth car sold in 2020 will be electric. Volkswagen (VLKAY) believes that EVs will make up 25% of vehicles sold from its own line in 2025. Norway already has announced a ban on the sale of fossil fuel-powered cars by the same year.

Supply Challenges

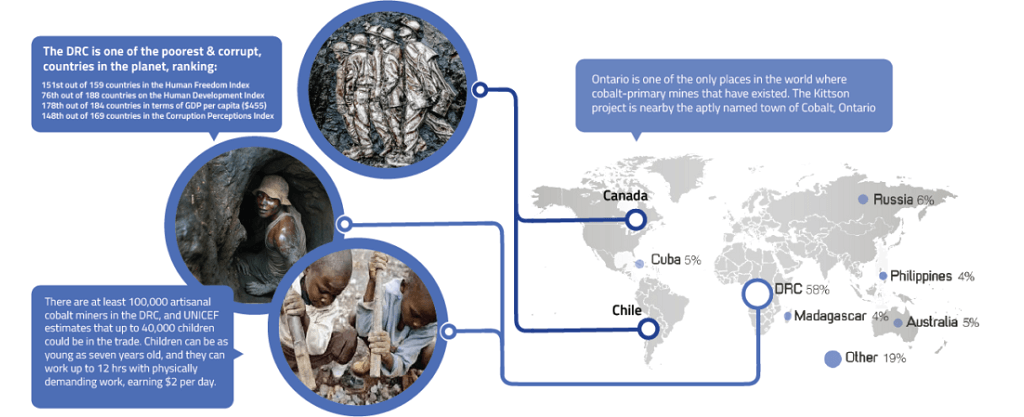

This explosion in demand explains why battery producers are facing a shortage of cobalt. Several cobalt producers have limited deliveries already because they simply cannot supply enough cobalt. Australia’s Macquarie Bank forecasts a deficit of 885 tons of cobalt this year. Next year, that deficit will jump to 3,205 tons and to 5,340 tons by 2019. Cobalt has an odd production profile. On the one hand, cobalt is everywhere on earth. On the other, its low concentrations mean that there are few primary cobalt mines. And as bad luck would have it, most of the world’s supply of cobalt comes from the politically unstable West African countries. In fact, 65% of the world’s cobalt production originates from the Democratic Republic of Congo (DRC) alone — one of the most challenging places on earth to do business. Even as demand for cobalt is exploding, the major superpowers are jockeying to control cobalt supply. The U.S. Defense Logistics Agency has started to stockpile cobalt, which it has designated “strategic and critical.