Lithium Properties

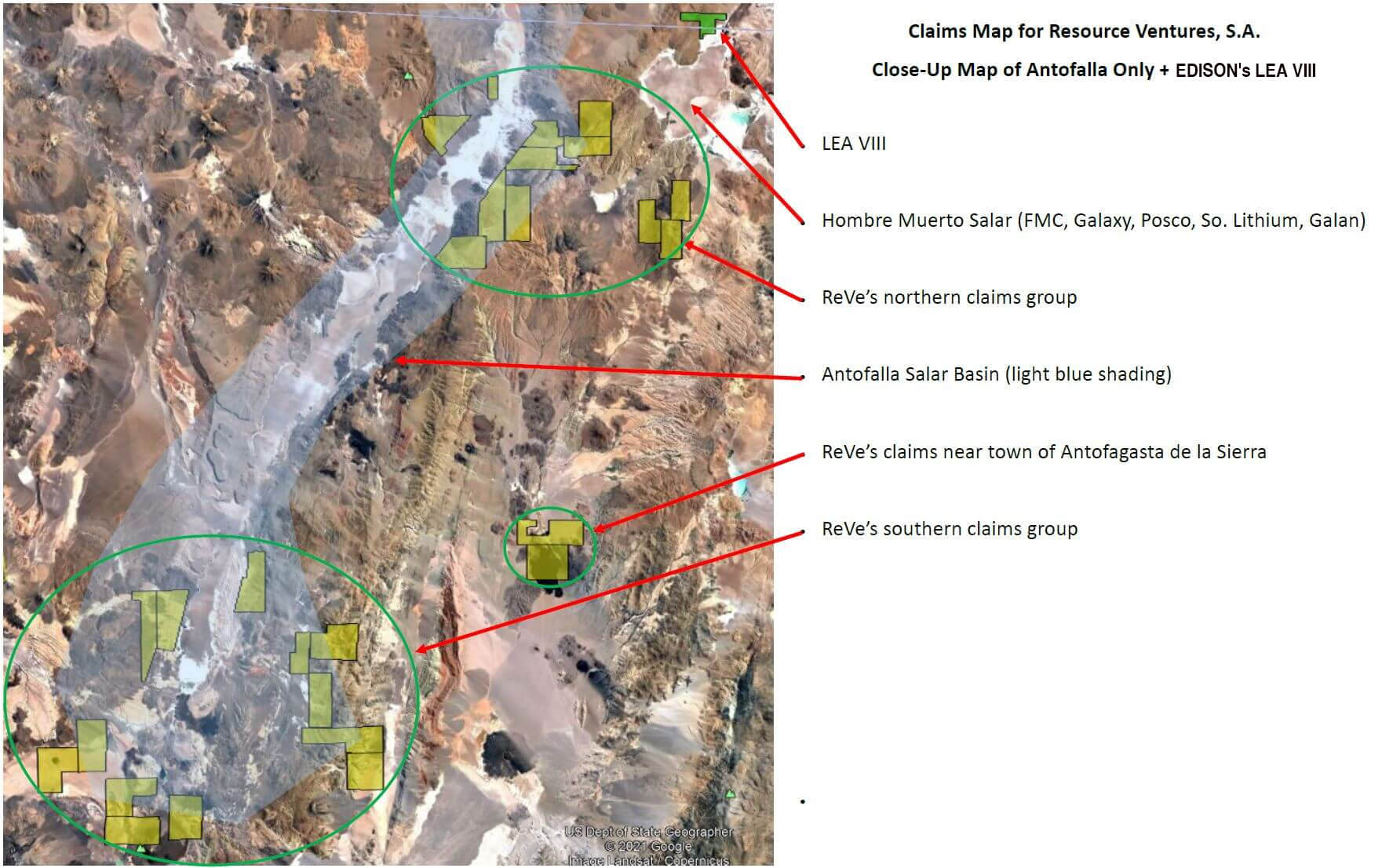

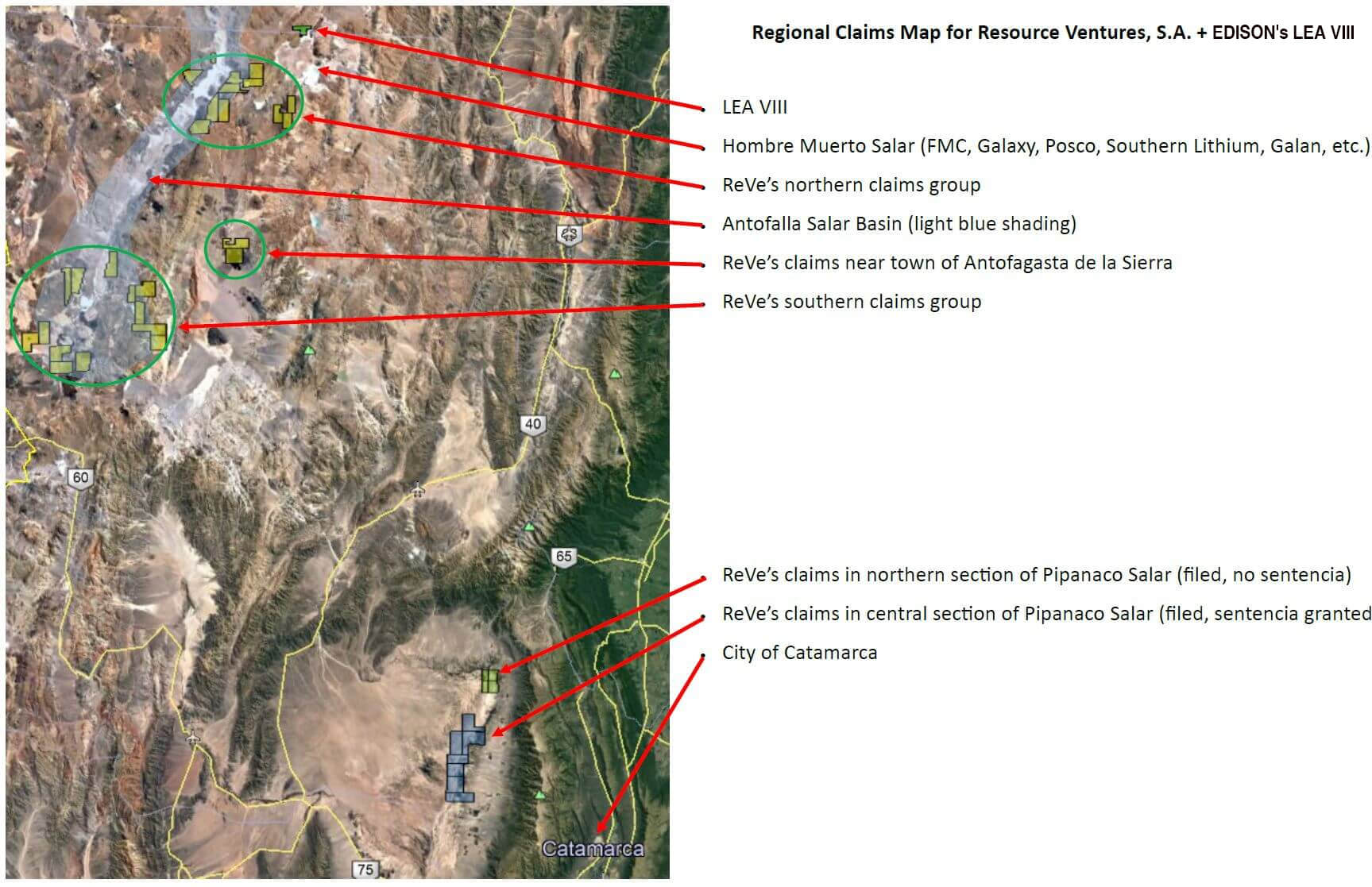

We entered into a Definitive Purchase and Sale Agreement to acquire Resource Ventures S.A., an Argentinian corporation that owns or controls the rights to over 148,000 hectares (365,708 acres) of prospective lithium brine claims in the province of Catamarca, Argentina. The claims are principally located in the two geological basins known as the Antofalla Salar and the Pipanaco Salar in South America’s famed Lithium Triangle.

Property Description and Location:

Salar de Antofalla (“Antofalla”)

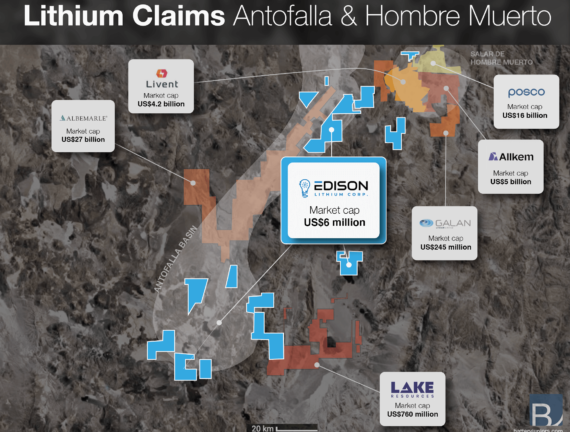

Located less than 20 km west of Livent’s producing lithium operation (fka FMC Corporation; Livent is Argentina’s largest lithium producer) in northern Catamarca Province, the Antofalla Salar hosts one of the largest lithium-bearing basins in the region. It is over 130 km long and varies between 5 km and 20 km across. On September 12, 2016, Albemarle Corporation, the world’s largest producer of lithium, announced that it had acquired from Bolland Minera, S.A., a large private mining company, exclusive exploration and acquisition rights to a claim block located in the center section of the Antofalla Salar. At that time, Albemarle publicly stated its belief that Antofalla has the third largest lithium brine reservoir in the world.

In 2016, Roskill information Services reported that Bolland had drilled 56 boreholes over 265 km² and defined a resource of 83mt of potash (KCl) grading 6,400mg/l and 2.22mt of lithium (11.8mt LCE) grading 350mg/l. Bolland’s test wells were drilled between 2008 and 2011 in the claim block now owned by Albemarle and were completed in conjunction with the Institute of Mineral Resources for the National University of La Plata in Buenos Aires (“Inremi”). Well logs, permeability, hydraulic gradient, core sample chemistry, and gravimetric studies published by Inremi during that period indicated substantial values for lithium and potassium continuously observed from the surface down to a depth of over 500 metres, suggesting that Antofalla is one of the deepest basins in the region.

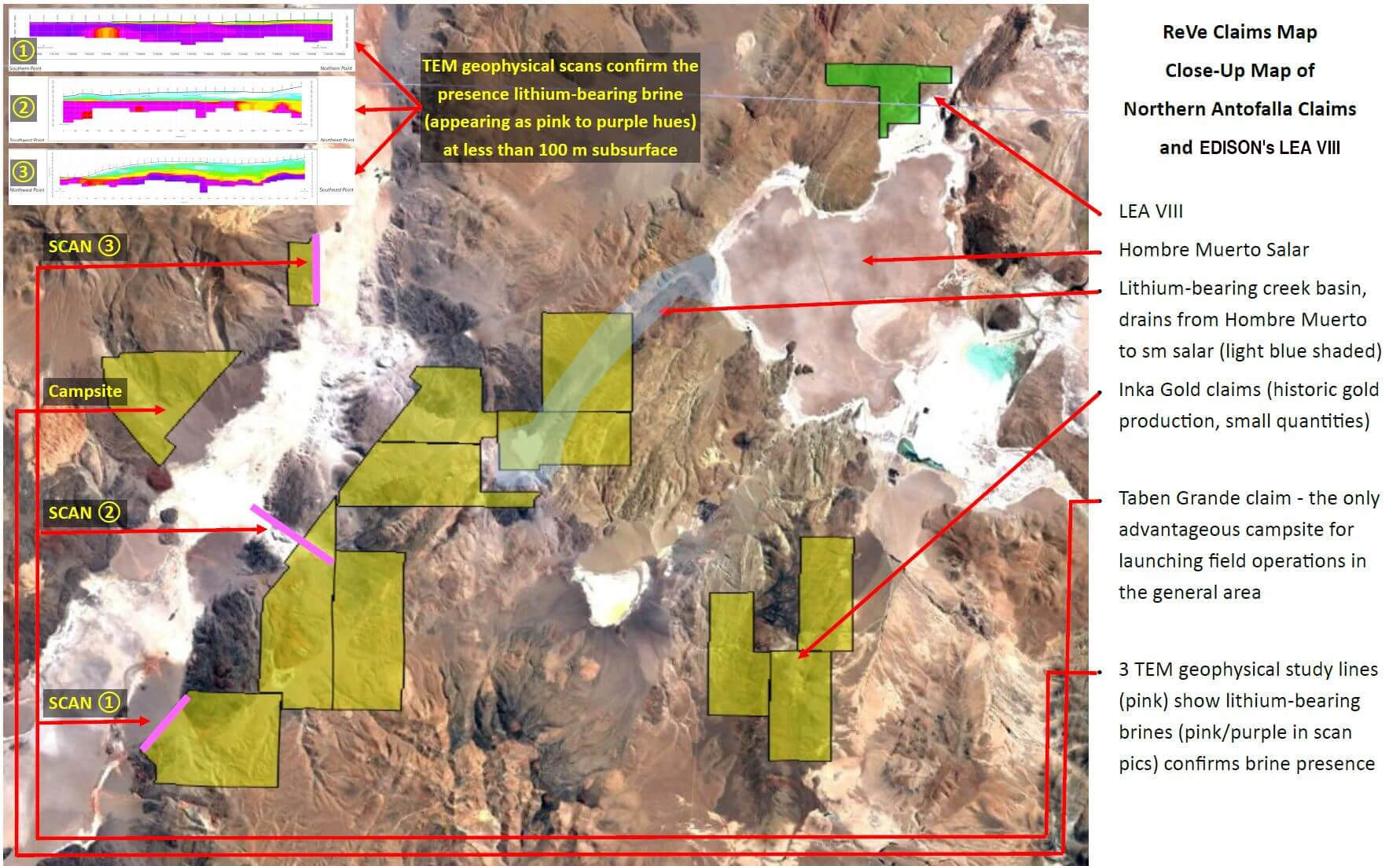

In 2018, ReVe secured TEM geophysical studies conducted by Quantec Geoscience Argentina S.A., including 187 soundings points conducted across 36.4 km of line scans covering approx. 15,655 hectares (38,683 acres) of claims in the northern area of its claims in the Antofalla Salar – all of which indicated the presence of prospective brines down to a depth of approx. 500 metres, which was the intended depth limit of the surveys. Brine in the basin could extend to even greater depths than the TEM scans revealed.

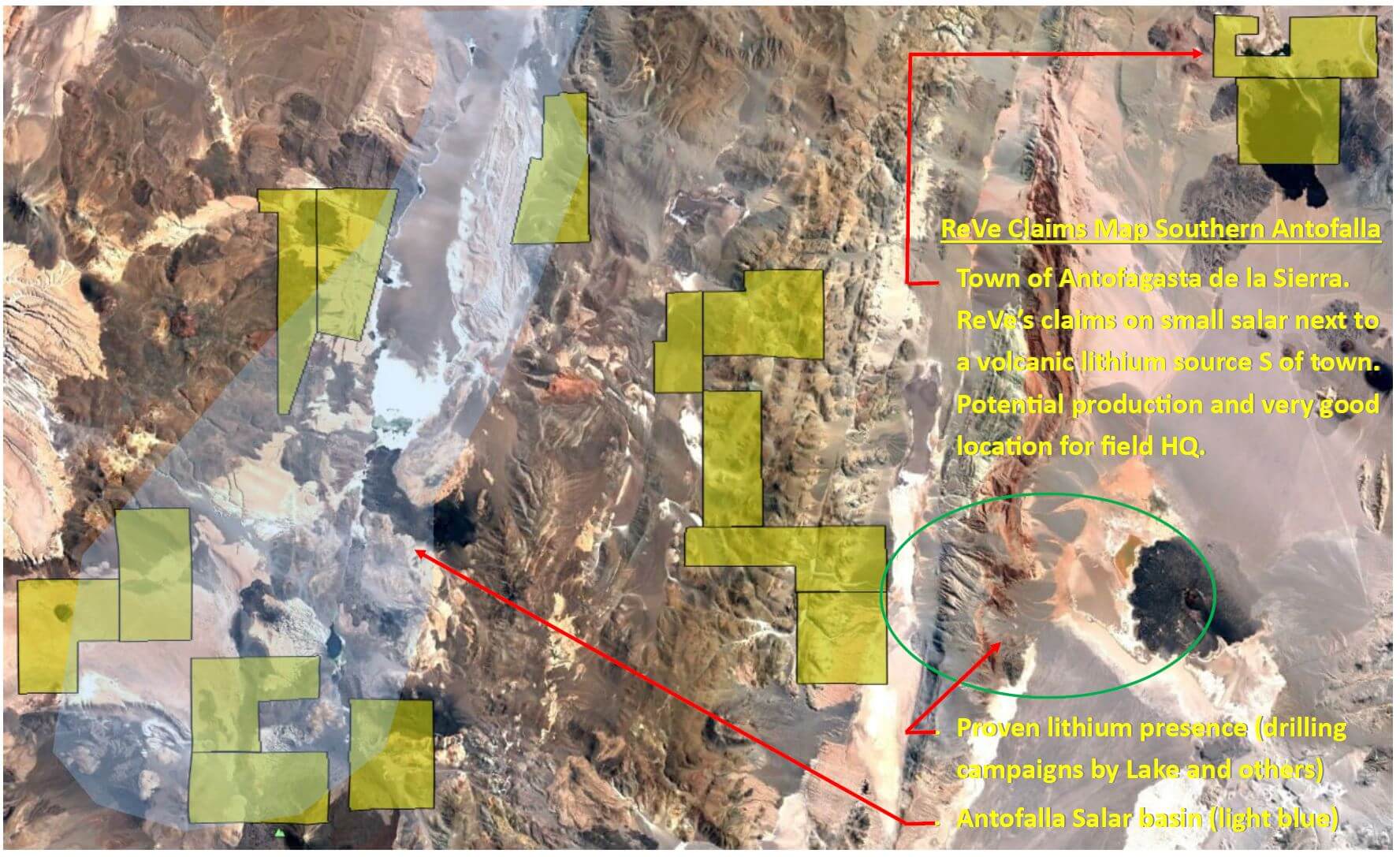

“ReVe’s assets in and around the Antofalla Salar are made up of approximately 107,000 hectares (264,397 acres) of semi-contiguous claims in the northern and southern parts of this salar, offsetting either side of Albermarle’s holdings in the center of this salar. This vast block of lithium claims creates what management believes are to be a very impressive entry point for EDDY as we enter the burgeoning lithium sector,” stated Nathan Rotstein, CEO of Edison. Large land holdings with viable brine represent extensive, long-life resources, which will be critical for both producers and buyers as this quarter of the energy metals space continues to mature in the future to meet the ever-increasing market demand for lithium.

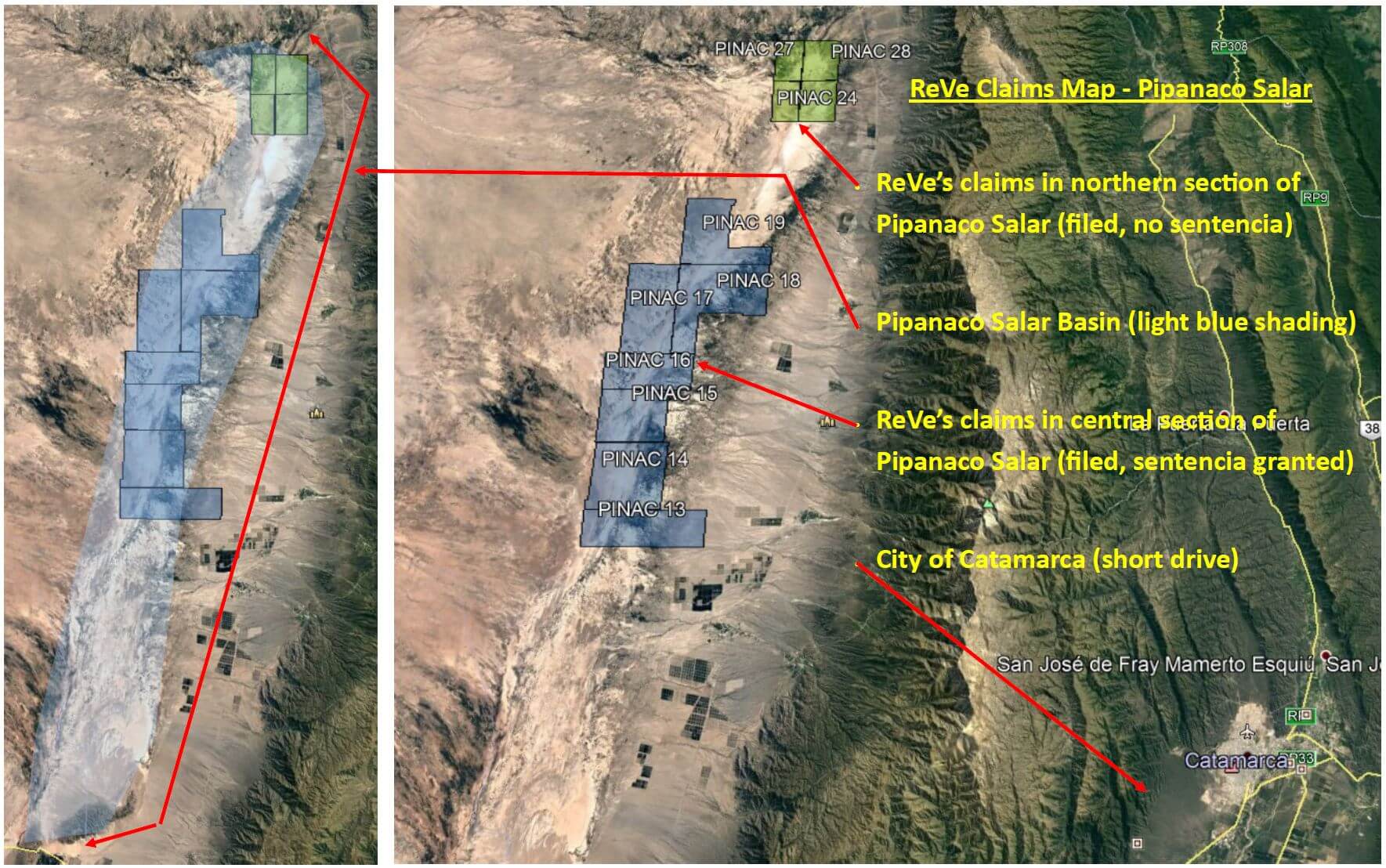

Salar de Pipanaco (“Pipanaco”)

ReVe’s claims in the Pipanaco Salar consist of over 41,000 hectares (101,311 acres) of core areas in this salar, which is located approximately 50 km due west of Catamarca city. These properties are in the very early stages of exploration with minimal surface samples having been collected to date.

This salar is at a much lower altitude than Antofalla and was drilled more than ten years ago in a program for the federal government of Argentina to identify new sources of fresh water. Based on those drilling reports, the Company believes that these Pipanaco holdings, which are located at only 700-750 meters above sea level, could represent a favourable site for a lithium extraction facility or a potash mine, as well as being a potential location to create a regional lithium processing facility located less than a two-hour drive from Catamarca city.

Nathan Rotstein (CEO) further comments, “Our initial emphasis will focus on developing our properties at Antofalla, as it is a globally renowned lithium basin. Our claims in the Pipanaco salar, while only early stage exploration, may prove to be strategic for a potential regional lithium processing facility located less than 50 km from Catamarca city. We believe this strongly positions the Company as a lithium player in South America’s famed lithium triangle, during an energy metals commodities bull cycle. Our growth will be accelerated by acquisitions within the lithium space.”

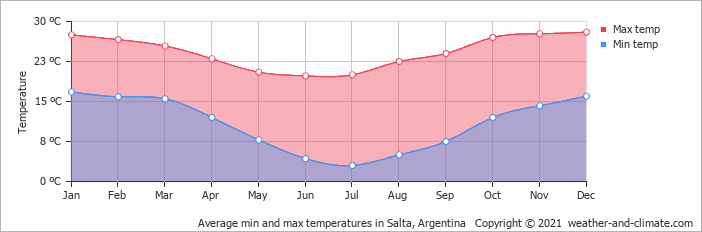

CLIMATE

The climate type is named “La Puna Desertica” (the Puna Desert) and is controlled primarily by the existence of orographic barriers in the west which remove most of the moisture from the humid Pacific air before it reaches the Puna plateau. The climate can be described as typical of a continental, cold, high altitude desert, with resultant scarce vegetation. Solar radiation is intense, especially during the summer months between October and March, leading to high evaporation rates. Work can be conducted year round, except when periods of high rainfall cause flooding in the salar. Climate is favourable for creation of evaporite deposits and brine.

GEOLOGICAL SETTING

Concessions within the Antofalla Lithium Property include lagoon and salar environments within the Puna geologic province, in the High Andes of northern Argentina. This section of the Andes is characterized by faulted and dislocated blocks that create a basin and range landform pattern. Elongated depressions running along a North‐South corridor host sub‐basin fault‐bounded ranges that in some cases contain Neogene volcanic edifices. These depressions were later filled by continental detrital sediments, as well as extrusive volcanics and/or ash flows. Intercalated within the sediments and volcanics is evaporite minerals, crystallized from sub‐basin brine aquifers within the N‐S elongated depressions. Historical work conducted by Rojas y Asociados in 2010 at the Laguna Caro site (corresponding to the easternmost concessions) reported a value of 304 mg/L Li in a 10 sample population.

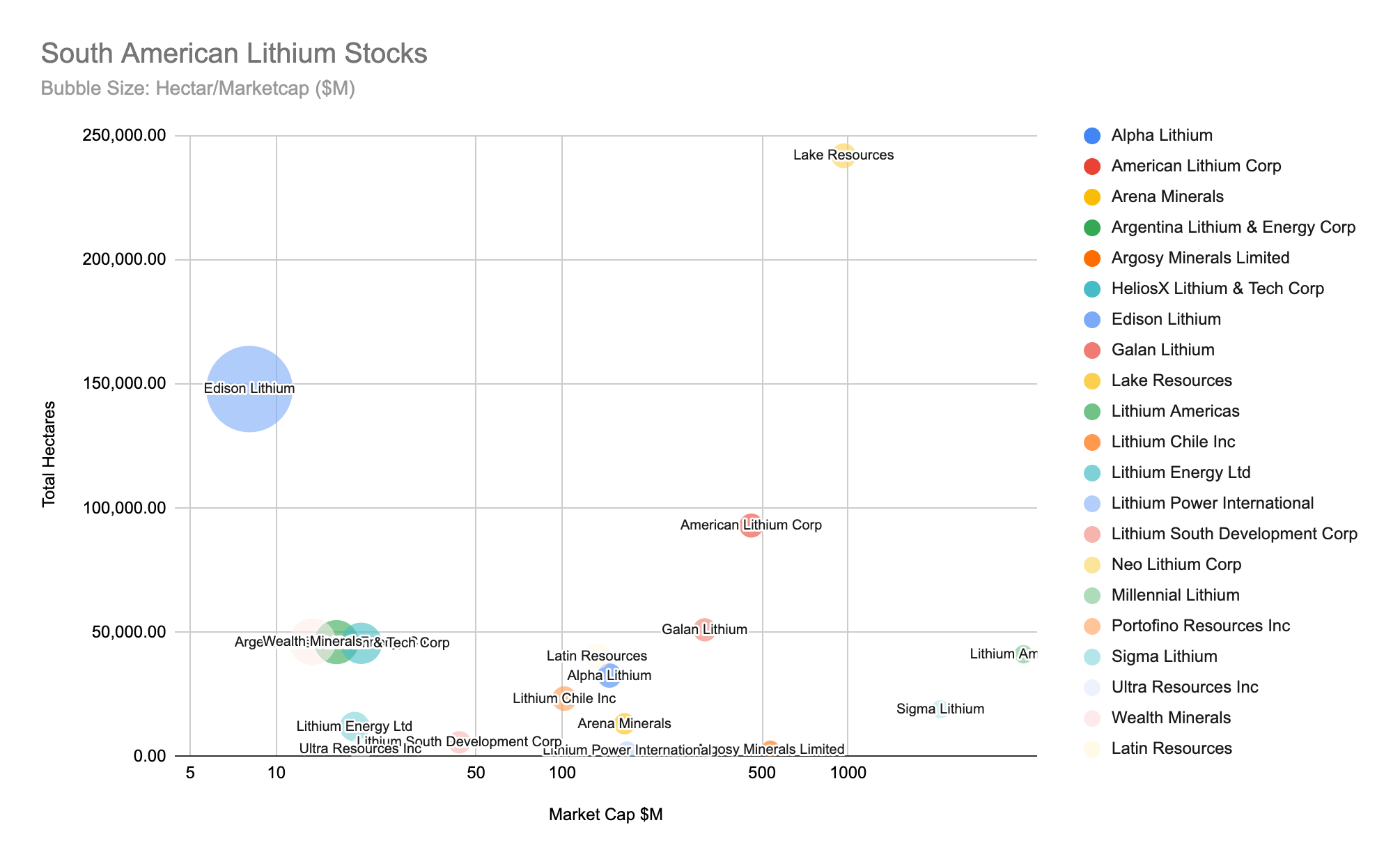

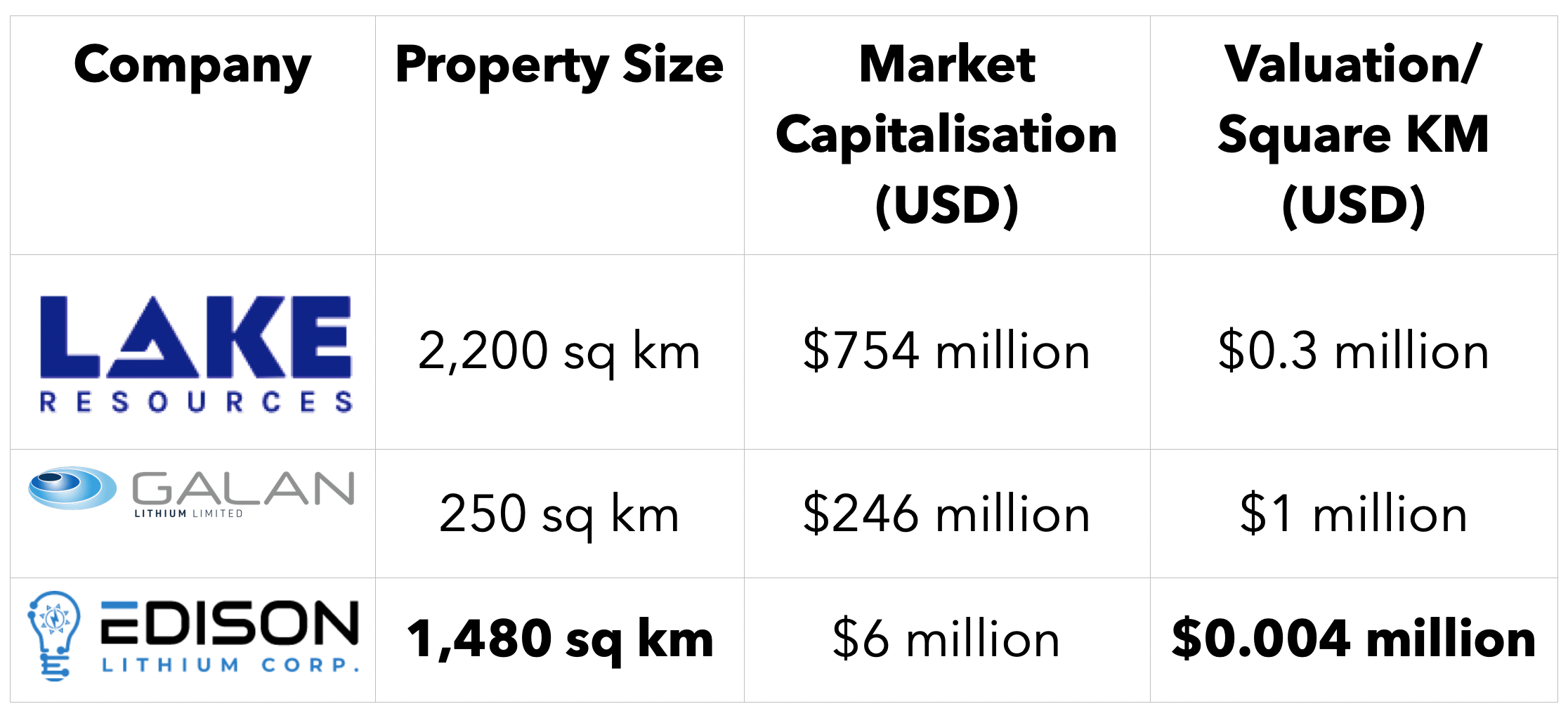

A Giant Property With Major Lithium Exploration Potential

The size of our properties is comparable to that of two neighboring lithium projects that have already defined their mineral resources:

If Edison Lithium Corp.’s properties were valued at Lake Resources’ multiples, the company would be worth $950 million, more than 95 times its current market capitalization. To achieve this price convergence, the size and extent of Edison Lithium’s lithium mineralization must be explored and defined – the key to increasing the project’s valuation and management’s top priority. To this end, an exploration program will soon be initiated.